The future of Italian design: trends from the Pambianco 2022 conference

The 8th design convention organized by Pambianco on July 5, 2022 in Milan was an opportunity to take stock of the current situation in the furniture market. In fact, the 8th Design Summit, titled The Future of Italian Design in the New Competitive Landscape – Distribution, Growth and Product Innovation, was attended by several key players from the world of furniture, finance, distribution and related sectors.

Furniture: a healthy market

Furniture: a healthy market

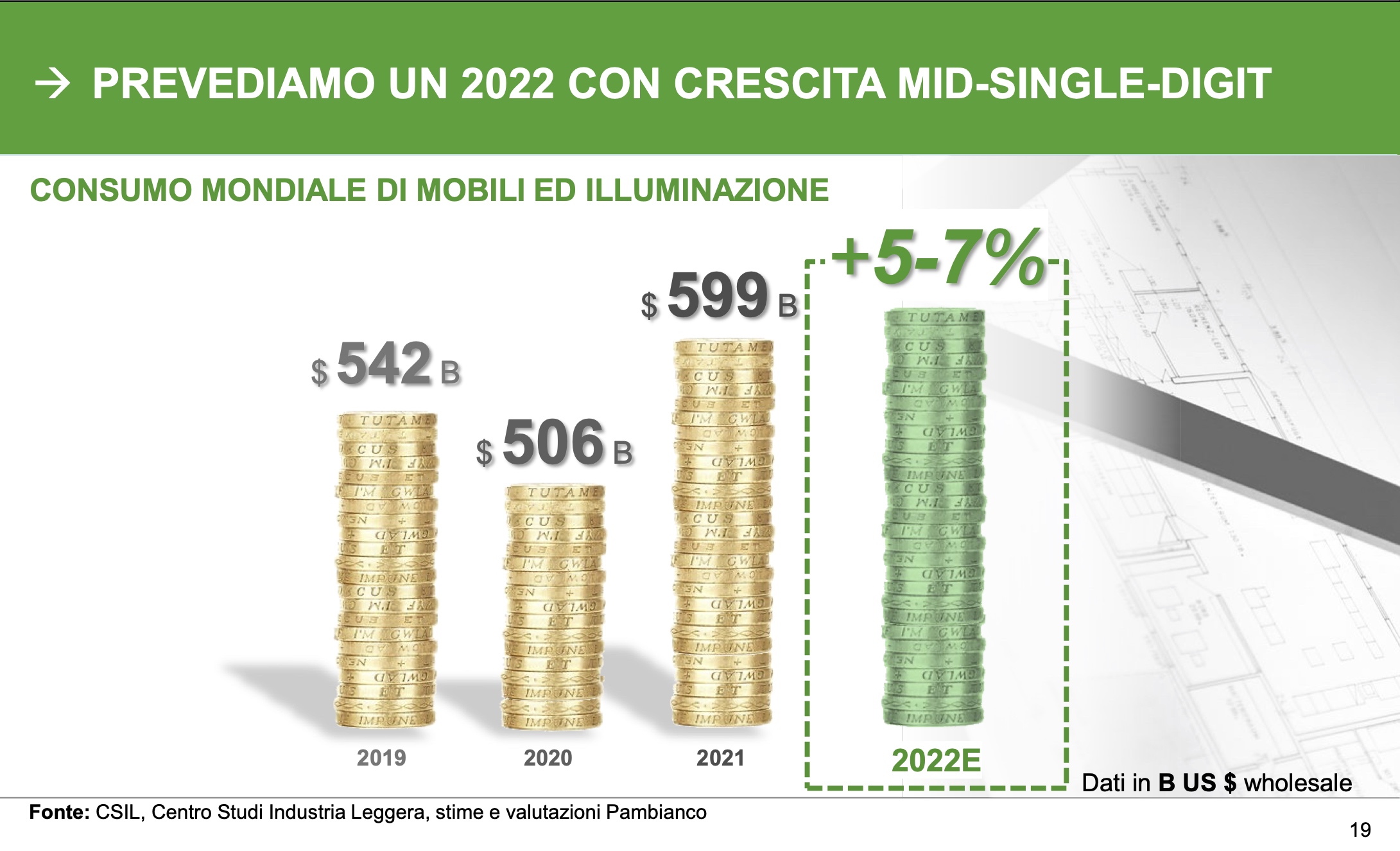

Alessio Candi, Pambianco Consulting and M&A Director, took stock of the market situation with the data processed by CSIL Milan. “The year 2021 – he explained – had a very strong rebound from the previous year, with an 18% growth, after 2020 had a 7% drop over 2019. Such a positive result is due to several factors. First, the business cycle for furniture products is a long one, so many projects did not stop during the pandemic. Moreover, the pandemic made people rediscover the home, so, during the two years of pandemic restrictions, furniture purchases increased.

Discover the forecast for the furniture market from CSIL Milano

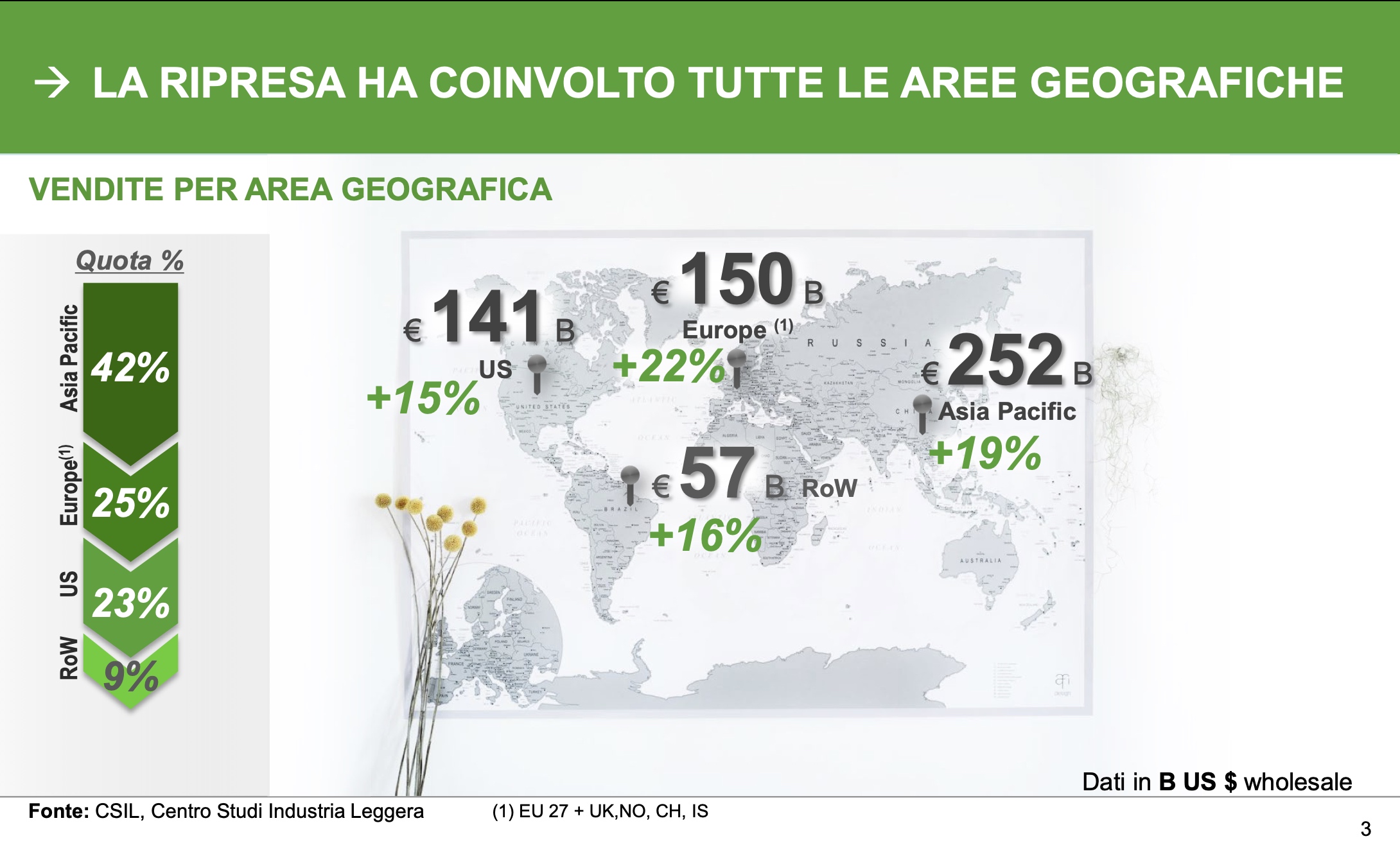

The situation of the world furniture market, therefore, is one of steady growth from 2009 to 2021 worldwide, with a compound annual growth rate of 3.7%. In 2021, furniture consumption increased by double digits worldwide, with Asia growing more than the rest of the world; the market size is $252 billion to date. Asia is closely followed by the United States ($141 billion) and Europe ($150 billion), and finally the rest of the world, which is valued at $57 billion.”

The contract industry is doing well

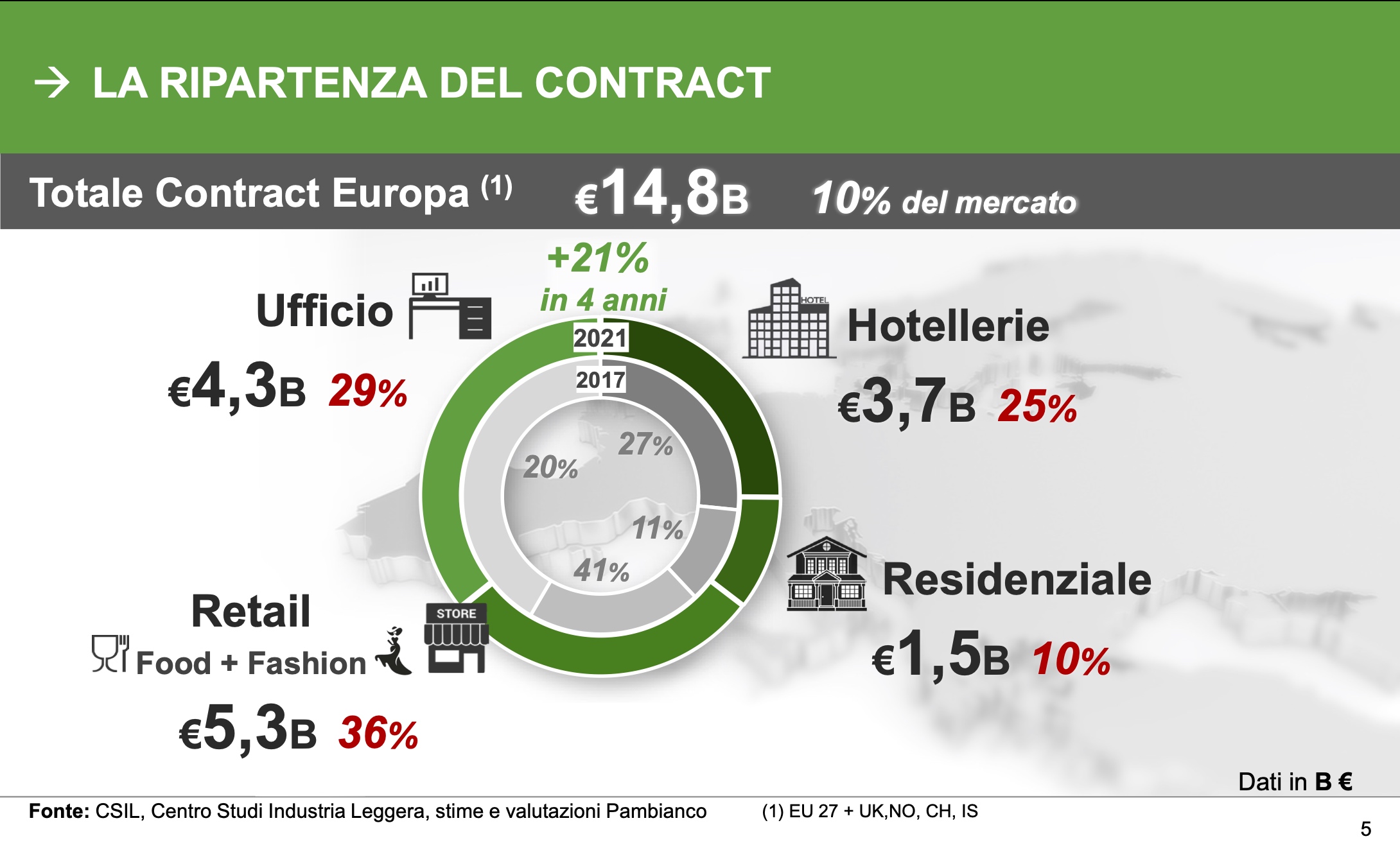

The industry, therefore, enjoys excellent health overall. Not only that: it is also evolving, thanks to several drivers of development. An important growth driver is the contract sector, which is valued at €14.8 billion in Europe and grew by 21% between 2017 and 2021, eventually accounting for 10% of the global market. The four macro-categories of contract are retail (food-fashion), which is worth €5.3 billion, or 36%; office, €4.3 billion, or 29%; hospitality, €3.7 billion, or 25%; and finally residential contract, which is worth €1.5 billion and accounts for 10% of the European contract market. Here it can be noted that office and hospitality are experiencing robust recovery.

Learn how the pandemic is changing the furniture retail, in the Design Summit Pambianco 2021

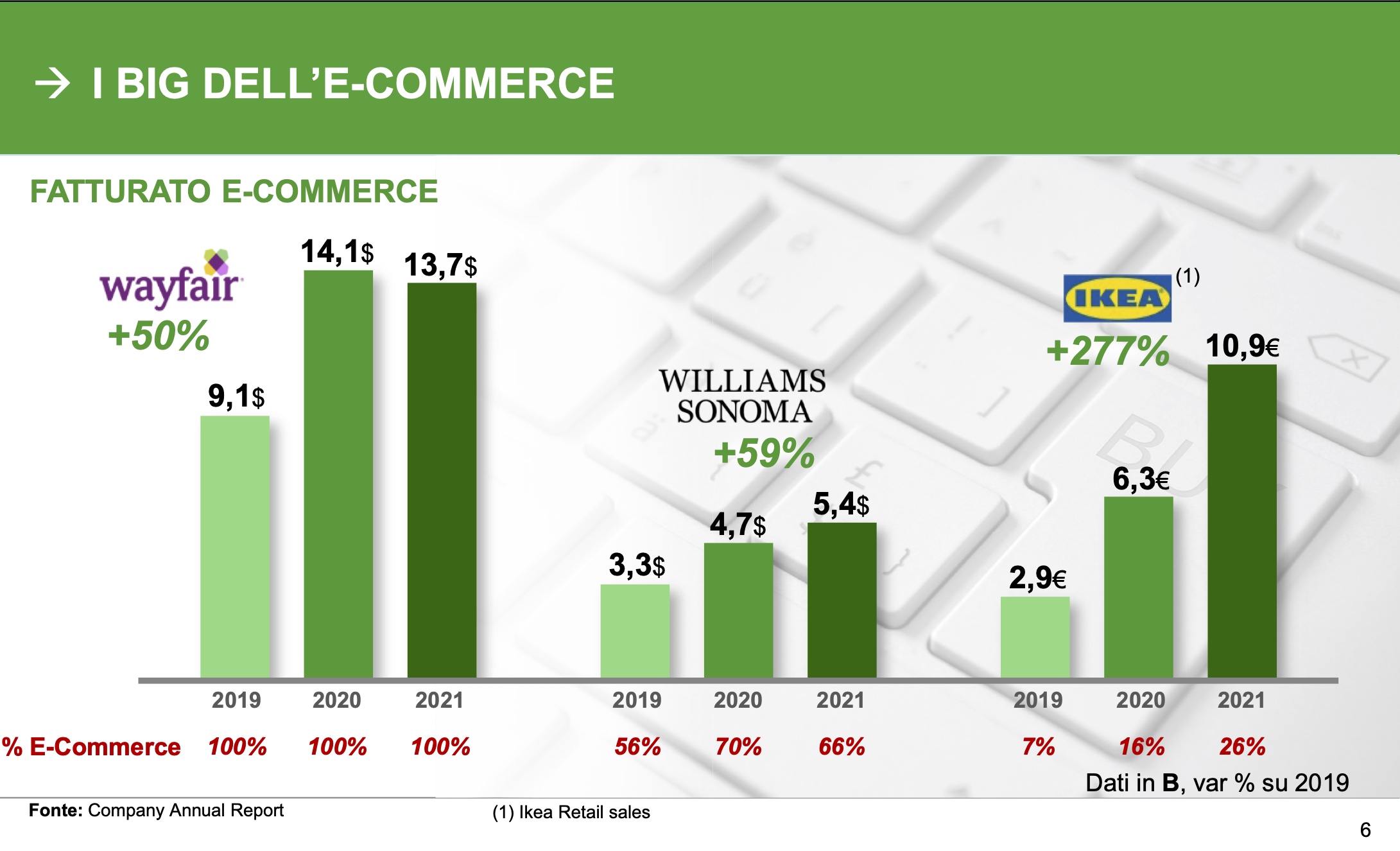

Alessio Candi’s talk also addressed e-commerce, another very important growth driver. Between 2020 and 2021, in fact, e-commerce performed very well, and in some cases even better. While some established players, such as Wayfair or Williams Sonoma, achieved +50% and +59%, Ikea’s online sales had an increase of 277%, from €2.9 billion to €10.9 billion, representing 26% of the Swedish company’s total sales.

Read “The Pambianco 2020 Design Summit”

In general, e-commerce performed well also for smaller players. Westwing had a 95% increase, from €267 million in 2019 to €523 million in 2021; Made.com +75 percent, from €212 million to €372 million; and finally, Mohd recorded a +57%, from €24 million to €38 million.

Merge & acquisition to grow

The last, but certainly no less important driver of growth is concentration. In fact, the design furniture sector is still very fragmented, although the M&A (Mergers & Acquisitions) sector is very vibrant. Between 2021 and 2022, there have been numerous acquisitions of Italian companies by investment funds, and for Design Holding, the group that also owns B&B Italia, a listing on the stock exchange is also expected. In general, major Italian companies had good revenue growths in the two years of the pandemic. They range from +42% for the Lifestyle Design group to +15% for the Molteni group (see table); and turnovers in millions also have interesting figures, ranging from 700 for Design Holding to 230 for the Calligaris group.

Finally, the trends. According to Alessio Candi, one of the main trends, and definitely a dominant one, is sustainability. Many companies now prepare sustainability reports, and the pursuit of sustainability in processes and products is increasingly present. Established trends that are growing steadily are the growth of contract and e-commerce and the increasing presence of technology in products. Moreover, especially at the high end of the market, there is increasing attention to consumers and their needs, to get to know them, after many years of paying attention almost exclusively to the product.

However, it is not all rosy. The sector has certainly been growing for two years, and it continues to grow, but already in the first quarter of 2022 growth is stabilizing, and it is hard to predict how the situation will evolve in the future. Among the guests at the Design Summit, Maria Porro, president of Salone del Mobile and marketing manager of Porro, painted a very clear picture of the current situation and what we can expect from the future.

Il Salone del Mobile.Milano

“The Salone del Mobile.Milano 2022 – Maria Porro explained – exceeded expectations. 27% of the exhibitors came from abroad, and we also began to replace those who could not be present, for example, with the entry of South Korea. Moreover, we had the opportunity to field test for the first time the importance of the digital dimension to develop more and more this aspect, which until three years ago was not given much consideration. That said, several unknowns are hanging over the future of the supply chain.

While it is true that the furniture macrosystem in the first quarter of 2022 recorded a +20% in both Italy and abroad, and the wood furniture supply chain a +24%, it is also true that the supply chain is facing major problems. In addition to the problem of material shortages, uncertainty about supplies makes it really difficult to work; quotes are made that are already outdated by the time they are processed, and this leads to margin compression. It also becomes difficult to meet delivery times. In short, this is a good period for Italian furniture, but we certainly should not rest on the successes of the moment.”

Design Conference Pambianco 2022: the spotlight on e-commerce and high-end design

Gilberto Negrini, CEO of B&B Italia, focused on the relationship between traditional sales, e-commerce, and high-end design products. “The players in this market – Negrini explained – have changed a lot. First of all, geography has changed, with China on its way to becoming the first market, the U.S. still expanding, and Europe needing profound reflection on traditional independent distribution. We, as D Studio, where possible, and as B&B Italia, are focusing on opening new stores, both directly operated mono-brand stores and third-party mono-brand stores.

Discover Design Holding

This does not mean that we do not believe in online sales. On the contrary, in our group we have acquired Lumens, a sales portal that has fundamental know-how, and we have just launched the B&B Italia online shop. However, the problem is being able to combine pure sales with the services we can offer, which are our strengths. That’s why I do not think e-commerce will become the preferred channel, but that does not mean it does not exist.”

Product innovation is more necessary than ever

Giulio Cappellini, a highly experienced entrepreneur, designer and art director, focused on product innovation. “The fact that many products that date back many years are still best-sellers – Cappellini began – shows that they were good designs. However, now more than ever there is a need to work on innovation, and perhaps different skills are needed to develop products that interact with new technologies. But not only that. What needs to be clear is that the company must be involved in these innovation processes all around so that evolution takes place at all levels. We need new, original, sustainable products, but the production processes must become sustainable as well, otherwise it would be a job half done. This will be increasingly necessary as the public is increasingly informed and demanding and will increasingly ask for clear and simple answers.”

Traditional furniture retail is still important

Giovanni Battista Vacchi, CEO at Colombini Group, addressed the importance of traditional retail. “For us, traditional retail is still key. The kitchen buyer is still wary of online sales, and it is not clear as yet how to replace the presence of the interlocutor in a showroom or how to check for proper assembly if selling online. What we are fairly certain of, however, is that the small independent stores will slowly tend to disappear in favor of directly operated stores, where one can have real control over all stages, including assembly. Certainly, these are major investments, and that’s why we need more and more economies of scale to enable that.”

[Txt Roberta Mutti]