An optimistic view comes from the sixth edition of the Design Summit, staged again this year by Pambianco in Milan on 14 July

The design industry and the challenge of recovery was the title of the Design Summit 2020, which investigated the impact of the crisis on the markets, and the actions of companies to overcome this hard time. Manufacturers, architects, and designers, retailers have been talking for over 3 hours, focusing on what awaits us shortly. First of all, the overall picture is positive: generally speaking, companies forecast that, if this continues, 2020 will end in decline, but all in all, the losses could be contained.

However, let us look in more detail about the situation in the manufacturing industry. Alessio Candi, from Pambianco, outlined the situation in the furniture industry.

Design summit and furniture: world market data

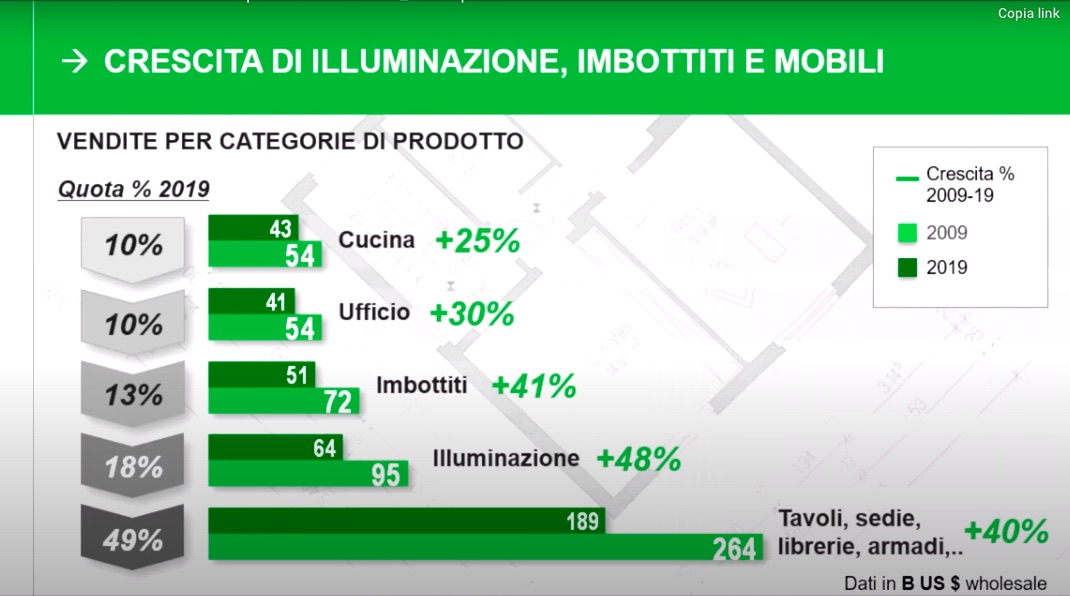

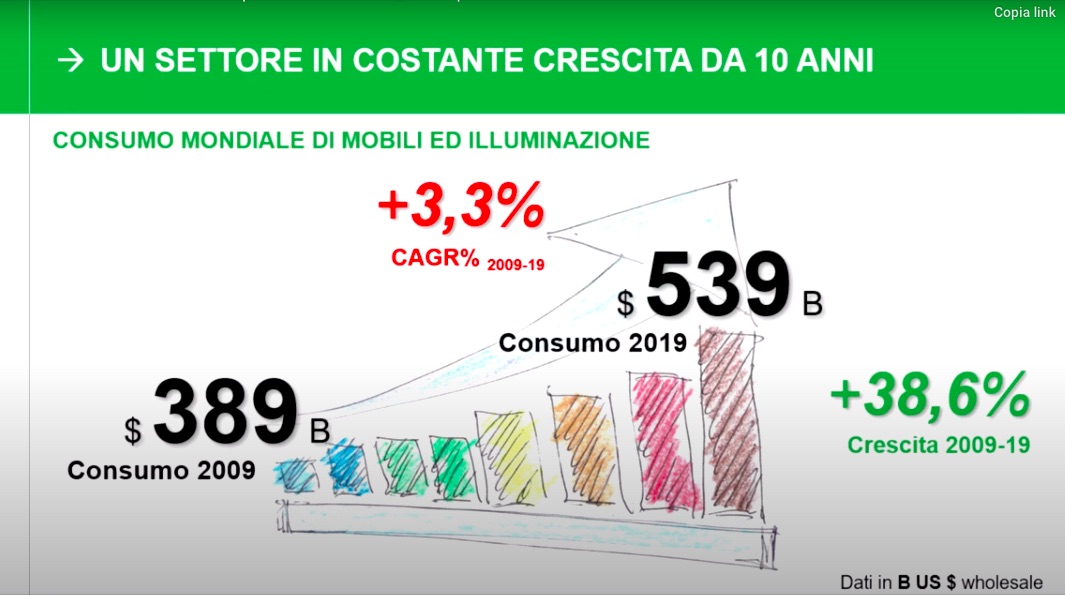

After ten years of substantially steady growth, there was already the first slowdown in world furniture consumption in 2019. In fact, from 2009 to 2018, the furniture consumption grew by 38.6%, from 389 to 547 billion dollars, while in 2019, it fell by 1.4% to 539 billion dollars (CSIL data). As for the product categories, tables, chairs, bookcases, and cabinets hold a 40% market share and increased by 40% in 10 years. Followed by lighting, with a share of 18%, and an increase of 48%, upholstered furniture, share 13%, increase 41%. Finally, office furniture, share 10% and a rise of 30%, and kitchens, also occupy a market share of 10% and experienced growth of 25%, 2009 and 2019.

Geographically, the Asia Pacific, which in 10 years grown by 83%, is worth 42% of the market, so it is indeed the world market driver. The EU 28, which is worth 24% of the world market, decreased by 2%; the US, which is worth 21%, increased by 56%, while the Rest of the World, with an increase of 17%, is worth 13% of the world market.

Future trend forecast in the design furniture market

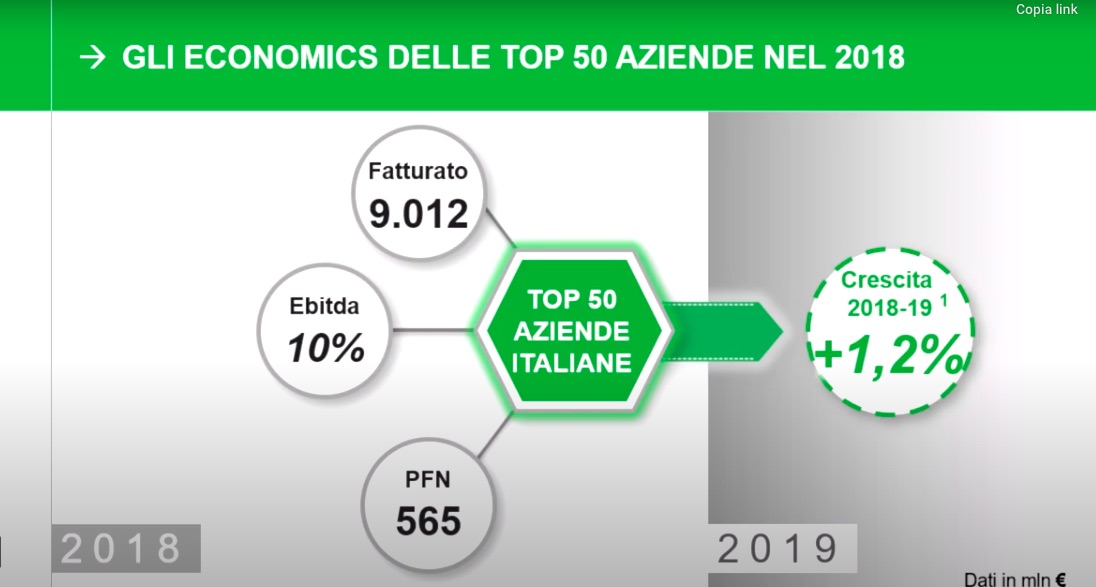

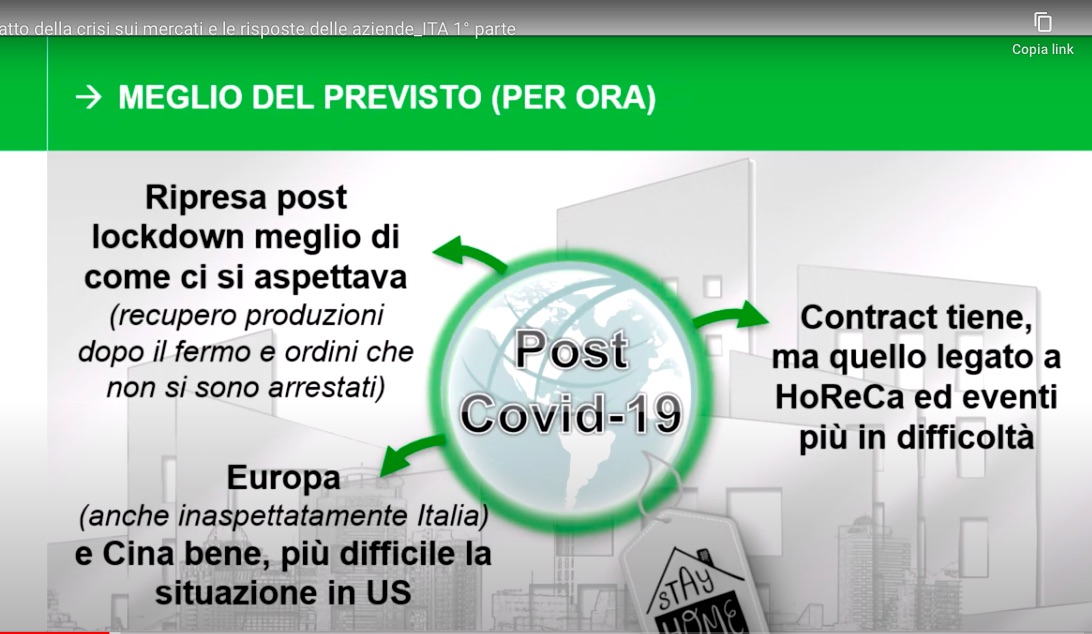

It’s not easy to forecast what will happen following the Covid-19 sanitary emergency. From the many speeches at the summit, it’s clear that companies are not so negative about the future, but it’s too early to get a real picture of what will happen this year. On 14 July, when the summit took place, the 50 leading Italian companies estimated that they would close 2019 with a growth of between 4 and 5% compared to 2018. For 2020, on the other hand, a rough estimate can be made of a loss of between 20 and 30% (which would already be a not thoroughly negative figure).

However, most businesses reopened and found a certain vitality on international markets, which allowed them to resume activity immediately, which bodes well for the recovery. However, we must be cautious, as Italy is the first western country affected by the sanitary crisis, and it has been the first to reopen. We can draw up a balance sheet only at the end of the year.

Smart working: how will houses and routines change?

Aldo Cibic, architect and designer who for some years now has been dividing his time between Italy and China, offers food for thought on the changes taking place in the lifestyle of the new generations. “Being in contact with my students between two continents, explained Cibic, gives the opportunity to see up close the different worlds. However, I see some common ground in everyday life, albeit in very distant places. Working from home, for example, is becoming increasingly popular. And this will of course bring changes in houses’ architecture, design furniture, and cities. If we work from home, we will need larger spaces and multifunctional furniture. Alternatively, or as a complement, there will be a need for co-working spaces.

Watch the webinar about the new Petite Maison collection, by Aldo Cibic for PhilippSelva

We will no longer have to go to the office every day, and that may be an advantage; however, we will still have to meet people. Therefore, co-working spaces may become more popular. In the long term, this different lifestyle will affect houses’ design, as well as urban planning and design furniture. For example, the cities may give way to the countryside, as there is no longer a need to live close to work. And we could live this moment as an opportunity to relaunch our beautiful Italian country.

Moreover, we can take advantage of this period to see what they are doing in the world, and maybe copy. For example, in Shanghai, I live in a working-class neighborhood where many urban regeneration projects are underway, mixing agriculture with the size of the urban community. We need to turn this difficult time into an opportunity to develop new projects.”

Outdoor and sustainability: the new frontier

The long months of lock-down led people to want to live outdoors. The real estate market is experiencing an increase in demand for houses and apartments with terraces and gardens. Among the objects of desire, outdoor kitchens are also emerging.

Read also Outdoor furniture and furnishings trends

The extensive discussions on the origin of the virus from over-exploitation of the animal world also push for a more sustainable approach, both in business processes and in the fabrication of objects and commodities.

Lorenza Luti, Marketing and Retail Director at Kartell, focused on the research of increasingly sustainable materials. Kartell has been investing in organic materials and wood for some years now. For example, in January of this year, Kartell launched the first chair is an entirely recyclable organic material. Then, for three years now, the research on wood continues, and even in upholstered furniture, there is a preference for the use of organic fabrics. Bio and natural materials are part of the brand’s innovation, which invests all the manufacturing processes.

Discover more on the Bio materials for furniture by Kartell

Design and furniture: e-commerce and digital

Finally, the big player of this complicated year, marked by the sanitary emergency: the digital, which allowed to continue working during the very long months of lockdown. The work organization leaped forward at least two years in two months, forced by the impossible to reach the offices. However, many firms are now discovering the advantages of remote working, and it is highly likely that there will be no turning back. Although the smart working arrangements will have to be discussed and shared, weighing advantages and disadvantages for each specific position.

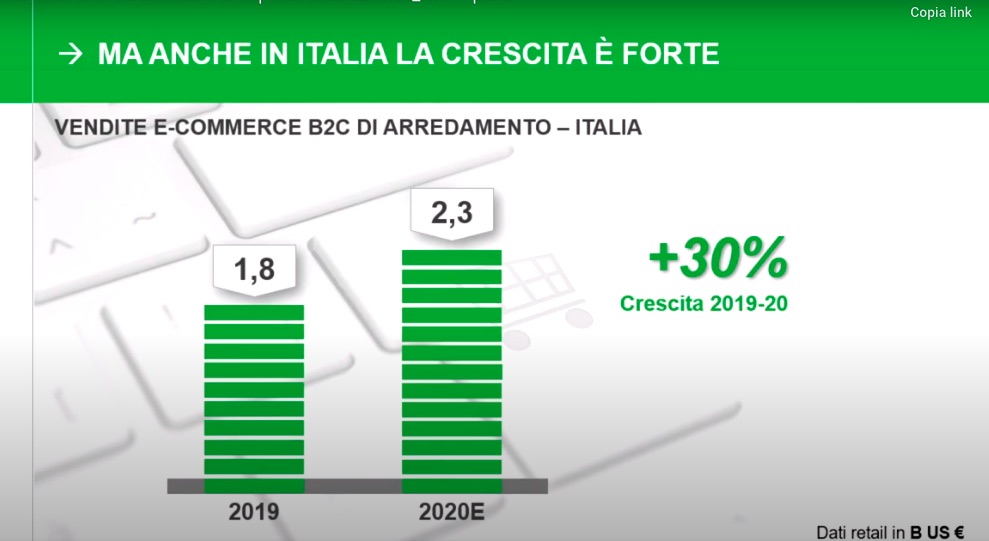

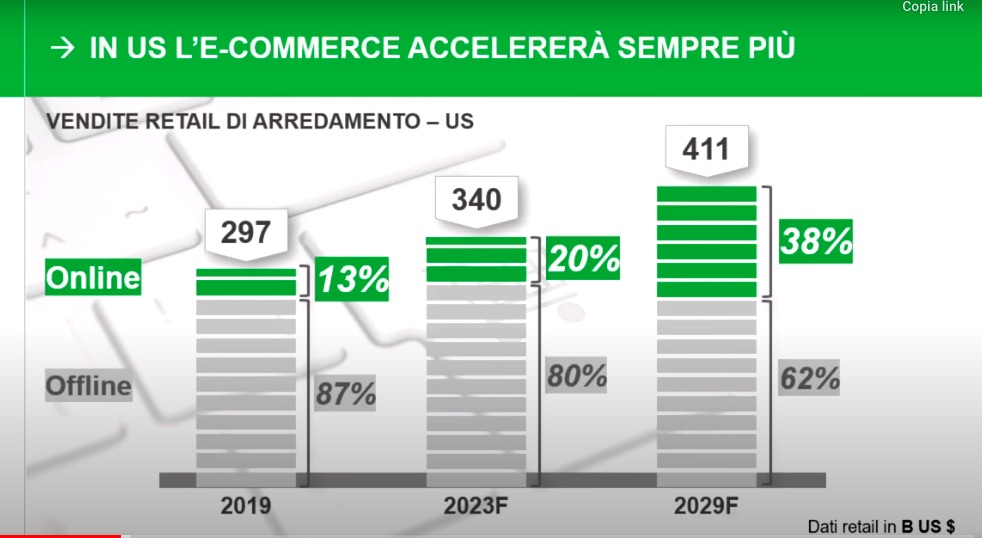

Indeed, those who benefited from the extended lockdown are e-commerce traders or e-tailers. Although they are very far from the United States, even in Italy, e-commerce furniture has grown by 30% in a year (these percentages are nevertheless very low, from 1.8 to 2.3%). However, for some retailers, it made the difference between carrying on or closing down.

Furniture e-commerce and traditional sales: an advantage for design

An interesting story came from Gianluca Mollura, the owner of Mollura Arredamenti, and the website Mohd.it. “During the health emergency, explains Mollura, we launched the new site, and today’s results confirm that we made the right choice. The online sale allowed us to stay in line with last year’s turnover, which would already be a good result. Our story is an unusual one, meaning that we were not born as e-commerce. Mollura Arredamenti is a store over 52 years old, and I am the second generation. Online sales began only in 2011, following the Great Recession, when we started to understand that we had to change something in our business. Then, our business grew until last year, and an equity fund turned its attention to us. Thanks to the new capital, we started real e-commerce, which today goes alongside the design business.

E-commerce probably won’t replace the brick-and-mortar store, but now the ease of buying online became part of our routine, and no one can think of turning back. However, I think there will be some distinction in the products, especially at the top of the range. I believe that online purchases will be mainly of simpler products, less demanding on customization. We have to start to understand that the customer who is buying wants to buy at that moment. If they don’t find what they are looking for, they change the brand and don’t wait to find that specific product, that brand. These are little changes in the purchase routine, which, over time, become dramatic.” [Roberta Mutti]

Click here for the complete video of the Design Summit Pambianco 2020