The furniture sector closes 2021 with positive results, but there are clouds on 2022

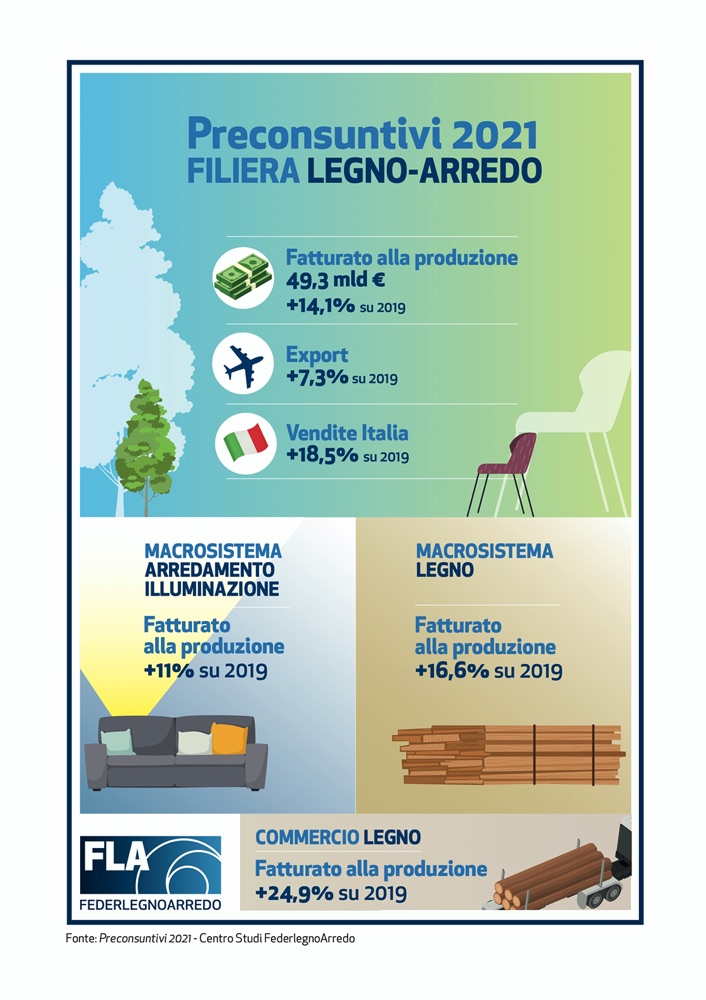

The state of health of the wood furniture supply chain offers a picture of positives and negatives. The year 2021 closed with a +14.1% compared to 2019, with a production turnover of over 49 billion euros, compared to 43 in 2019. A nice growth also for exports: +20.6% on 2020; +7.3% on 2019, for a value of over 18 billion euros. This value exceeds, albeit slightly, the 17 billion euros of 2019, consolidating a recovery of exports, which weigh more than 37% on the entire sector. The Italian market, in turn, records a 18.5% growth compared to 2019 and +28.9% on 2020.

Therefore, the preliminary figures drawn up by Centro Studi FederlegnoArredo certify a return to pre-covid levels in the sector, or rather their overcoming; however, the high cost of energy, the shortage of raw materials, and logistics costs risk reversing the trend as early as the first months of 2022. And the war in Ukraine, with all its consequences, is worsening a situation that was already beginning to deteriorate, due to all the related factors.

Read furniture market forecasts for 2022

Prices will rise and (perhaps) put the brakes on recovery

“Going from -9.1% in 2020 on 2019 to +25.7% in 2021 on 2020, reaching the double-digit result of 2021, is undoubtedly an excellent result; this testifies to the ability of the companies in the wood furniture industry to respond to the crisis of the last two years. Nevertheless, – comments Claudio Feltrin, president of FederlegnoArredo – now a state of criticality and deep uncertainty prevails due to the situation of the early months of 2022. We are faced with a mix that really risks pulling the handbrake on the sector’s recovery and we must make a big effort to keep growth at 2021 levels. Until now, we have deployed all strategies to avoid price increases, but unless external conditions change quickly, we will have no choice but to raise prices to the public, with the consequent risk of a decreasing demand.”

Read the trends in consumption of durable goods

The contract sector and tourism move slowly

The difficulties of tourism are well known. Istat data says that in the first nine months of 2021 the number of guests in hotels dropped by 44.3%; according to Assoaeroporti estimates, air traffic closed with a 58.8% drop in passenger traffic over 2019 (-70.4% in international traffic). “The contract sector will have to wait until at least 2023, if not 2024, to return to pre-Covid levels – continues President Feltrin. The sector follows different dynamics from the home furnishings market, and those working for the hospitality industry are still dealing with a slowdown. Partly compensating for these dynamics is outdoor furniture, both for homes and bars and restaurants, thanks also to the free concession of open-air spaces. However, the still negative forecasts on the recovery of tourism, confirmed by airline forecast that postpone the return to normality for long-haul travel to 2024, are worrying.”

The export of the wood furniture supply chain

The export of the wood furniture supply chain is positive and records a +20.6% on 2020 and +7.3% on 2019, for a value of over 18 billion euros, which consolidates a recovery of exports, which account for over 37% of the entire sector.

All of the top 10 export markets are growing, and France is confirmed as the top export country for products from the supply chain; although it is now considered a mature market, the size of Made in Italy exports and growth rates make it a trade outlet that remains promising.

The Russian situation

The weight of Russia on the export of the wood furniture supply chain is 410 million euros (data updated to November 2021), which in 2019 was 435, thus recording a decrease of about 6%.

On the other hand, the furniture and lighting macro system is worth around 340 million euros, 361 in 2019, another 6% decrease. In the export “ranking” of the furniture macro system, Russia is the 9th country, behind China, Spain and Belgium.

As far as imports are concerned, the wood furniture supply chain is worth 136 million euros, recording a 41.2%, increase compared to 2019, demonstrating how much raw material we import from this country.

Russia: a timber provider and an important buyer

“A fact – explains Feltrin – that, in the light of the current geopolitical developments, can only make us keep our guard up. Not only is Russia a market to which we export our products, but it is also an important provider of timber. Russia’s role is fundamental in controlling prices: if it blocks timber sales, as it has already begun to do since January, this will cause prices to rise even higher. Countries like China, for example, are willing to pay any price to import wood, and this will affect the end consumer. Our companies could find themselves managing a situation in which they are unable to process orders due to the lack of raw materials while they are oppressed by the high cost of energy, which is already being reflected in the price lists of finished products”.

Numbers to which we must add a value that cannot be measured directly, which corresponds to the consumptions of the Russians who live also and above all abroad and are used to buy Made in Italy products, especially in the luxury range. Therefore, it is easy to imagine that the block on Russian bank accounts will have heavy negative repercussions also on our sector.

The Italian wood furniture market

FederlegnoArredo’s provisional results show a growth of the entire supply chain of 18.5% over 2019 and 28.9% over 2020; this growth is due to both the effectiveness of tax breaks such as the bonus mobili and the rediscovered centrality of the home in the lives of Italians. “Already since January – explains Feltrin – there have been signs of a slowdown, which risk becoming major clouds. We cannot say that the market has stopped, but it has certainly stiffened and got frightened due to the prolonged uncertainty. We hope that the situation turns positive so that the industry can ride the wave of positive 2021 results.”