From the Findomestic Observatory on consumption and consumer credit a positive picture emerges for the furniture market in 2021

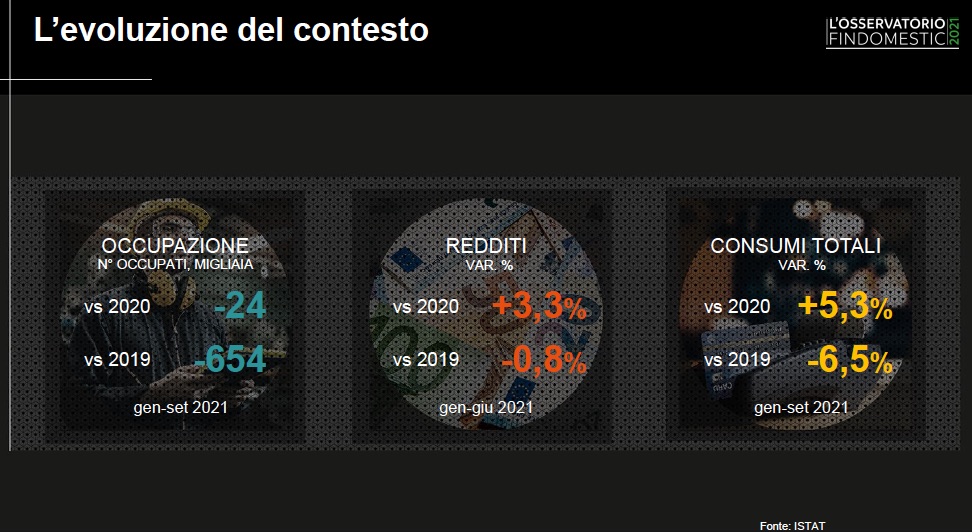

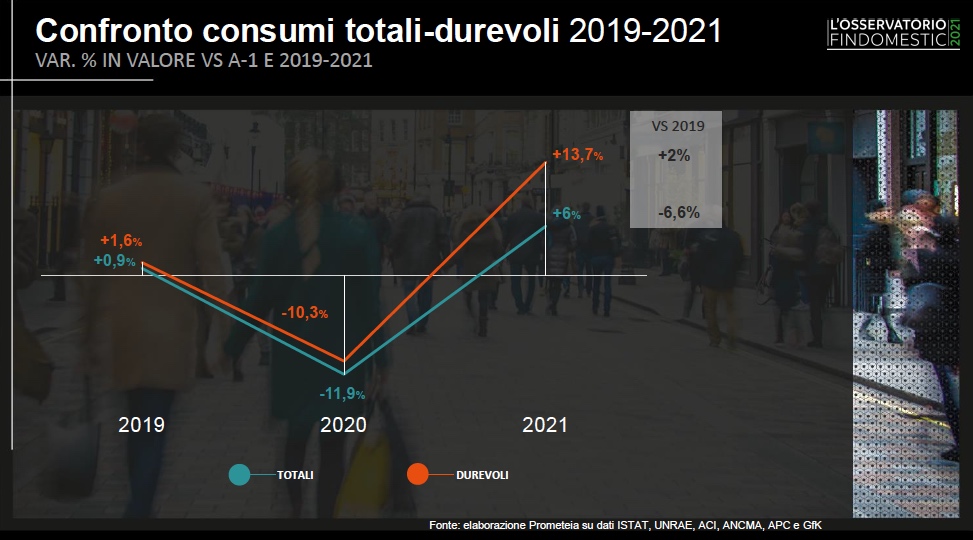

Despite the good results of 2020, due to the forced presence in our homes, 2021 opened with some criticalities, mainly in the first quarter. Until April, in fact, pandemic restrictions kept consumption down. Starting in April, as restrictions eased, consumption rebounded, with a 5.2% increase over 2020. Growth has spread to all consumer segments, but especially to services as a result of people’s newfound mobility. The home-related market continues the growth that began in 2020, with the furniture market expected to grow by 16.1% in 2021.

At the end of the first half of 2021, domestic consumption was 3.7% higher at constant prices than in the corresponding period of 2020. However, we must keep in mind that in the first half of 2020 the tight lockdown caused a sharp decline in consumption. So, compared to the first half of 2019, consumption is still 10.5% lower, at constant prices. In particular, services are still 18% lower and semi-durable goods, especially clothing and footwear, are 16% lower.

Also see Csil Milano’s forecasts for the furniture market

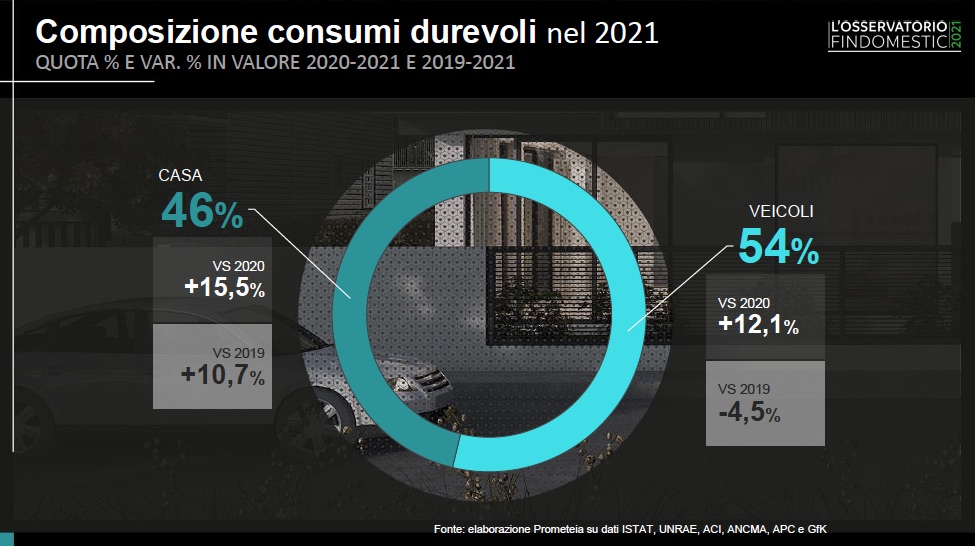

Consumption of durable goods was 3% higher than in the first half of 2019, driven by demand for technology and household goods; renovation incentives also played a role in the growth. On the contrary, consumption of non-durable goods, including food, was essentially stable.

Forecasts for the second half of the year

The very favorable summer season should have continued to support demand for services, which was already growing, partially thanks to the resumption of international tourism. The contribution of other expenditure components is likely to be less significant. If the current trend continues, domestic consumption is expected to grow by 4.2% in 2021, at constant prices. However, at the end of the year the gap with 2019 will be -8.2% (-6.6% in value). For 2021, a stronger rebound is expected for durable goods consumption, supported by the strong focus on energy efficiency and environmental sustainability as well as incentives for renovations. Unfortunately, many elements of uncertainty are still present, due to the evolution of the pandemic. A further factor of instability derives from the increase in inflation, which could reach 4%; moreover, the greater weight of compulsory expenses (household utilities, etc.) could drain resources from consumption, thereby slowing recovery.

Discover the Altagamma Observatory 2021 on post-pandemic consumption

The home, furniture and technology market in 2021

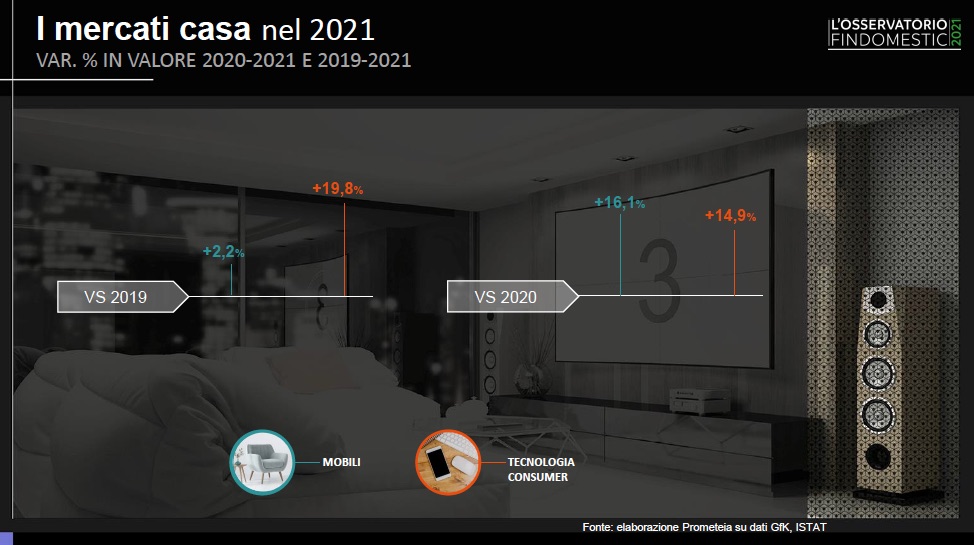

In the home goods market, a 15.5% increase in value is expected, which will bring sales in 2021 to levels 10.7% higher than in 2019. This is a major achievement, stemming primarily from consumer technology, +14.9% in the current year. Small appliances record +7.4%, but the growth is decelerating after the 2020 jump. Also rebounding strongly are furniture purchases, +16.1% in value, with a +2.2% increase over 2019. After the setback of 2020, in 2021, the furniture market resumes the growth started after the Great Recession. However, the value of the market remains at 8% lower levels compared to 2007.

Also see Csil Milano’s forecasts for the furniture market

A positive impact came from the Furniture Bonus, the Renovation Bonus and the Superbonus tax incentives, which also drove furniture upgrade. Finally, online channels confirm their role as relevant. After the growth experienced in 2020, near to 60%, according to the B2C eCommerce Observatory of the Politecnico di Milano, online sales of furniture and home living products will increase by 18% in 2021. New market operators’ technological tools facilitate and accelerate the development of e-commerce, also in the furniture sector.

Also read Selling furniture online after the pandemic

Within the furniture market, the kitchen furniture segment seems to record the greatest growth. GfK research institute reports 80% growth in the first eight months of 2021, a figure that must consider the collapse of the first months of 2020 but that nevertheless confirms a restart. The trend observed in the months of July-August is very lively, about +38%, both for the independent distribution channel and for the large chains. Expectations for the second half of the year are of a substantial stabilization at pre-pandemic levels, which will allow a 29% growth of the market in value; therefore, at the end of the year, the market should record +22% over 2019.

Discover the Altagamma Observatory 2021 on post-pandemic consumption

You can find the full Findomestic report on the website of the Findomestic Observatory